Sonny Mao 苹果保险和理财专家专访

毛圣麟(Sonny Mao)是一位保险和理财专家,工作于苹果保险与理财(Apple Insurance & Financial Services, inc),跟最大的科技公司之一苹果同名。他的团队提供个人保险及理财服务。他们致力于为客户及其家庭提供保障 产品及服务,因为他们坚信正确的保险及理财服务可能改变一个人的人生。他的团队提供各类人寿保险(定期及终身,储蓄及可变型寿险),解决教育规划问题,个人退休规划,服务长期护理保险,残疾收入保险,健康保险,年金,生前信托,公司保险及理财服务。在保险业有一条铁律:正确的公司保险及理财服务可提高员工忠诚度,保障业主及合伙人、核心员工,并确保公司永续经营。其中为公司专门设计的产品及服务包括公司退休规划,买卖协定,核心人员保险,团体医疗及人寿保险。他的专业知识以及他覆盖的服务区域能够帮助满足绝大部分客户的需求。

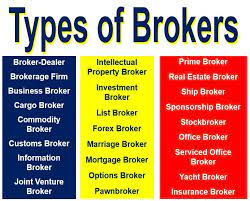

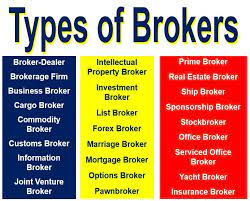

在我们介绍其他东西之前,我们需要先了解什么是经纪公司以及其员工的职责。经纪公司,也被称为经纪人交易商,代表客户(经纪人)为自己的银行(交易商),或者两者一起,购买和销售证券,例如股票,债券,共同基金(Mutual Funds)以及其他投资产品的业务。为经纪人交易商工作的销售人员通常被称为经纪人。投资顾问通过向客户提供有关证券的建议而获得报酬。此外,一些投资顾问管理投资组合并提供财务规划服务。

金融专业人士同时担任经纪人和投资顾问的情况较为常见。

接下来谈一谈保险,这一行业的水比较深,所以了解各个保单的保值范围以及价格估算是非常重要的。很多人可能不太了解各类人寿保险有何区别。终身寿险是一种永久性人寿保险并附有储蓄成分。在保障期内保费维持不变。保单除现金外还会有保险公司发放的红利,用于应急。若保险人不幸身故,保险公司会将保金及累积红利赔偿给受益人。储蓄寿险有固定有效期,以储蓄为主要目的,保费相对最高,无论保障期到时保险人如何,保单持有人都会获得一定保金。定期寿险设有特定有效期,没有现金价值或储蓄成分,保费最低,若有效期内保险人身故则会赔偿,反之失效。

受长时间疫情影响以及最近的疫情反弹,各种金融经济市场都不容乐观。在债券市场方面,政府债券收益率持续下降,股市波动和利率下降也在对401(k)s产生负面影响。当账户价值下降,预期利息收益可能大大减少时,很难为退休做准备。有几个方面需要考虑:社会保障 – 社会保障提供终身收入,并有美国政府的承诺支持。它还有助于抵御通货膨胀、利率下降,并有助于减少你的资金过期的机会。因此,社会保障的灵活性与401(k)或IRA资产相结合,可以提高退休财富。低价购买 – 如果你在未来10年内工作并向你的401(k)供款,而股票价格较低,你持续的401(k)供款将购买更多的股票。如果市场在你退休时复苏,你最终拥有的401(k)财富可能比2020年的熊市从未发生时还要多。清偿债务 – 外出的次数减少了。考虑将这些储蓄用于偿还信用卡和贷款。虽然你不能肯定地预测你在大多数投资上的回报率,但你知道当你还清收取15%利息的信用卡时,你会 “赚 “到15%,或在还清4%的汽车贷款时,你会赚到4%。比较省了一分钱便是转了一分钱,甚至可以用剩下的资产计划在退休时用来购买年金。

无论是在上班还是休息时间,只要有客户咨询,毛圣麟先生总会最快解答客户的疑惑。他的效率,客户至上的态度,以及一丝不苟的责任精神使得他吸引了很多新客户的同时,留住了很多老客户。在当地的中文网站上,不太使用社媒的他仍然获得了许多客户网上的满意评价。

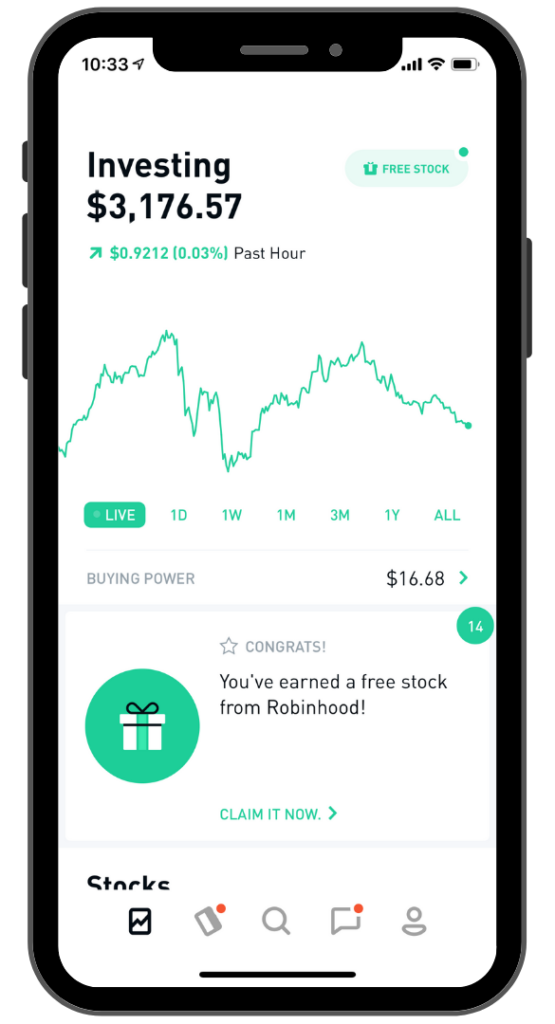

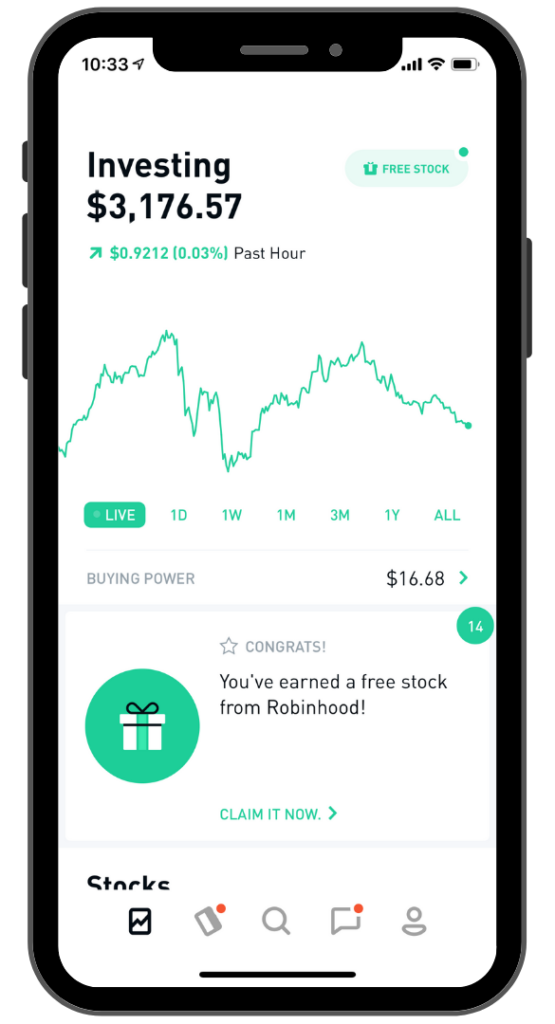

在最近的话题新闻里,毛圣麟专家谈到了Robinhood上市首日失利的故事。 Robinhood是一个很火的线上交易平台,前几天在那斯达克(Nasdaq)挂牌交易,但开局不利,收盘大跌8.4%,跌破发行价,显示投资人对这个平台兴趣缺缺。 Robinhood上市首日失利,正是这家公司和股票承销商极力想避免的情况。他们把发行价订在价位区间的下端,对该公司估值约320亿美元。消息人士透露,Robinhood和投银希望采取保守做法,以确保首日交易取得成功,部分是因Robinhood将很大一部分股票卖给散户投资人。除了关于股票或保险的新闻,毛圣麟专家也会偶尔在个人网站上分享一些时事,比如Covid,疫苗,健身,身体健康及饮食健康等等,能够帮助到观众的日常生活并提供指示。

毛圣麟先生名下有两个主要办公地址,一个在工业之城(City of Industry),靠近罗兰岗,另一个在科罗纳(Corona)。因为主要服务群体是华人,他能够很好地服务到华人区的地方,因为那里会有更多需要帮助的人。他在罗兰岗的地址位于一栋大楼,非常有办公的职业氛围。住在附近,并需要这方面咨询或者帮助的人,毛圣麟先生会提供最细致,个人化的服务。

Website: https://www.ccyp.com/client/index/22734

电话:(626)715-0048

营业时间:周一到周五:上午9:00-下午5:00

地址:1101 California Ave., #100, Corona, CA 92881

Address: 17588 E. Rowland St., #A156,City of Industry, CA 91748

Sonny Mao is an insurance and financial expert, working for Apple Insurance & Financial Services, the same name as one of the largest technology companies, Apple. His team provides personal insurance and financial management services. They are dedicated to providing protection products and services to their clients and their families because they believe that the right insurance and financial services can change a person’s life. His team offers a wide range of life insurance (term and whole life, savings and variable life), solutions to education planning issues, individual retirement planning, services for long-term care insurance, disability income insurance, health insurance, annuities, living trusts, corporate insurance, and financial services. There is an iron rule in the insurance industry: the right corporate insurance and wealth management services will enhance employee loyalty, protect owners and partners, core employees, and ensure the sustainability of the company. Among the products and services designed specifically for companies are corporate retirement planning, buy-sell agreements, core staff insurance, group health and life insurance. His expertise and the areas he covers can help meet the needs of most clients.

Before we go into anything else, we need to understand what a brokerage firm is and the responsibilities of its staff. A brokerage firm, also known as a broker-dealer, is in the business of buying and selling securities, such as stocks, bonds, mutual funds and other investment products, on behalf of a client (broker) for their bank (dealer), or both. Salespeople working for broker-dealers are often referred to as brokers. Investment advisors are compensated for providing advice to clients about securities. In addition, some investment advisors manage investment portfolios and provide financial planning services. It is very common for financial professionals to work as both brokers and investment advisors.

Next, let’s talk about insurance. The industry is relatively deep, so it’s important to understand the coverage and price estimates of each policy. Many people may not understand the difference between the various types of life insurance. Whole life insurance is a permanent life insurance policy with a savings component. The premium remains the same for the duration of the policy. In addition to cash, the policy also includes a bonus from the insurance company for emergency purposes. In the unfortunate event of the insured’s death, the insurance company will pay the premium and accumulated dividends to the beneficiary. Endowment insurance has a fixed term and is primarily for savings purposes, with a relatively high premium. The insured would have a guaranteed amount of fee paid back regardless of his/her life status at the end of the coverage period. Term life insurance has a specific expiration date, no cash value or savings component, and the lowest premium. The insurance company will pay the promised fee only in the unfortunate event of the insured’s death during the insured period.

As a result of the prolonged pandemic and the recent rebound of the pandemic, various financial and economic markets are not optimistic. In the bond market, government bond yields continue to decline, and stock market volatility and declining interest rates are also negatively impacting 401(k)s. It is difficult to prepare for retirement when account values are declining and expected interest earnings may be significantly reduced. There are several areas to consider: Social Security – Social Security provides lifetime income and is backed by the promise of the U.S. government. It also helps protect against inflation, declining interest rates, and helps reduce the chances of your money expiring. Therefore, the flexibility of Social Security combined with 401(k) or IRA assets can enhance retirement wealth. Low purchase price – If you work and contribute to your 401(k) over the next 10 years and stock prices are low, your ongoing 401(k) contributions will buy more stock. If the market recovers when you retire, you could end up with more 401(k) wealth than you would have had if the 2020 bear market had never happened. Pay down debt – get out less. Consider using those savings to pay off credit cards and loans. While you can’t predict with certainty your return on most investments, you know you’ll “earn” 15% when you pay off credit cards that charge 15% interest, or 4% when you pay off a 4% car loan. Comparing pennies saved is pennies transferred, and you can even use the rest of your assets to plan for an annuity in retirement.

Whether he is at work or on his day off, Sonny Mao always answers a client’s questions as quickly as possible. His efficiency, customer-first attitude, and meticulous responsibility have helped him attract new clients while retaining many of his old ones. He has received many positive online reviews from clients on local Chinese websites, despite not using social media much.

In a recent news story, expert Sonny Mao discussed the story of Robinhood, a popular online trading platform that was listed on Nasdaq a few days ago, but got off to a bad start, closing down 8.4% below its offering price, indicating a lack of investor interest in the platform. The loss was exactly what the company and its underwriters were trying to avoid. They set the issue price at the lower end of the price range, valuing the company at about $32 billion. Sources said Robinhood and the investment bank wanted to take a conservative approach to ensure a successful first day of trading, in part because Robinhood was selling a large portion of its stock to retail investors. In addition to news about stocks or insurance, Sonny Mao also occasionally shares current events and hot topics on his personal website, such as Covid, vaccines, fitness, health and diet, which can help and guide viewers in their daily lives.

Sonny Mao has two main office locations, one in the City of Industry, near Rowland Heights, and the other in Corona. Since the main service group is Chinese, he is well positioned to serve the Chinese community where there are more targeted people in need of help. His address in Rowland Heights is in a building with a very professional office setting/atmosphere. For those who live nearby and need advice or assistance in this area, Mr. Mao will provide the most detailed and personalized service.

Website: https://www.ccyp.com/client/index/22734

Tel:(626)715-0048

Business hours:Mon-Fri:9:00am-5:00pm

Address #1:1101 California Ave., #100, Corona, CA 92881

Address #2: 17588 E. Rowland St., #A156,City of Industry, CA 91748